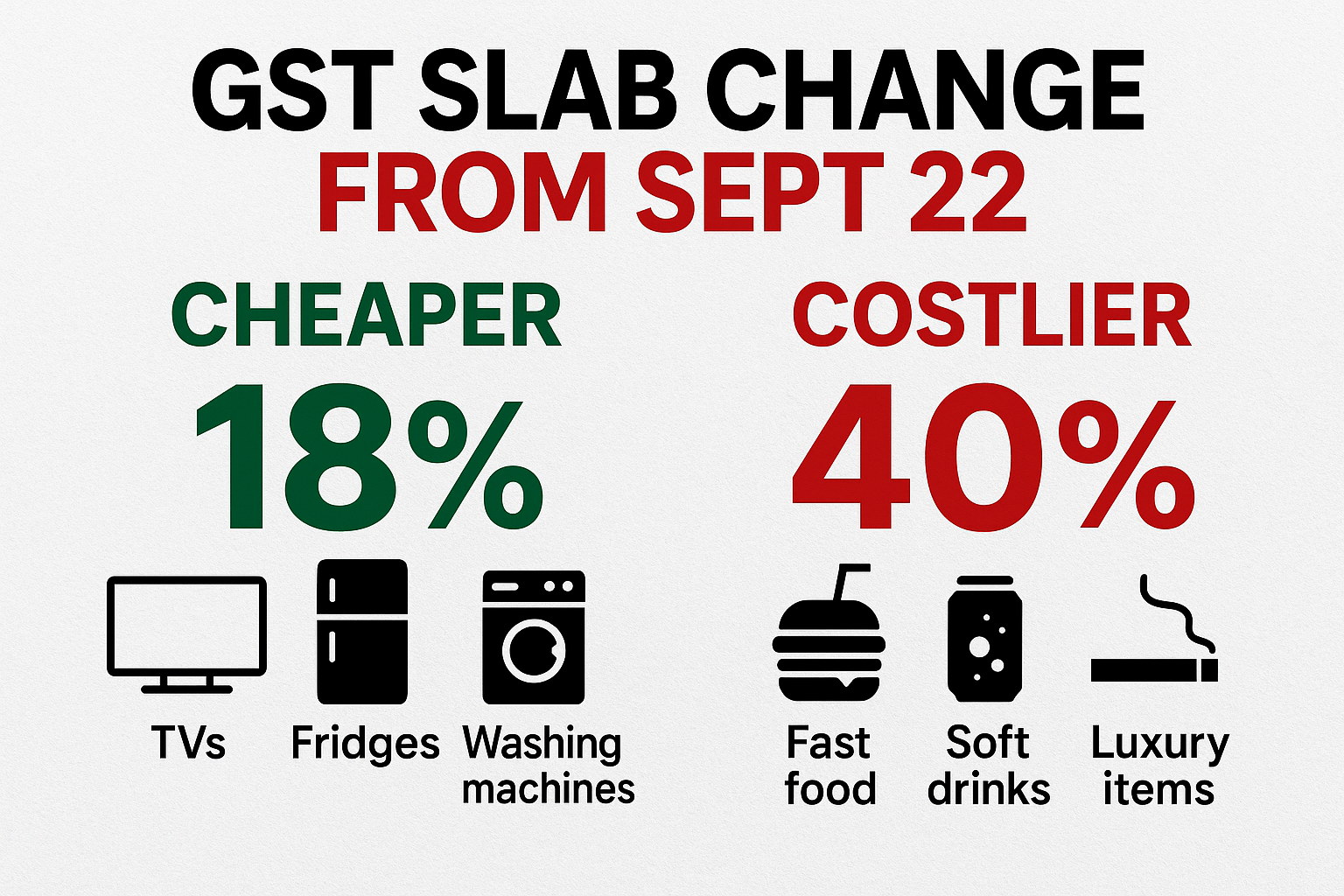

New Delhi, Sept 6, 2025 – In a major tax reform, the GST Council has approved a restructuring of the Goods and Services Tax (GST) slabs. The decision, taken at Wednesday’s meeting, abolishes the 12% and 28% slabs, leaving only 5% and 18% as the standard rates. Additionally, a special 40% tax slab will apply to luxury and health-damaging products.

The new rates will come into effect from September 22, 2025.

What Gets Cheaper

-

Electronics & Appliances: Items like TVs, refrigerators, washing machines, laptops, and mobile phones, earlier taxed at 28%, will now fall under the 18% slab. This move will bring significant relief to households planning upgrades.

-

Agriculture Essentials: GST on tractor tyres, farming machinery, drip irrigation systems, fertilizers, and micronutrients has been slashed from 18% to 5%. Farmers are set to benefit the most from this revision.

-

Food Staples: Everyday items such as flour and rice will see reduced tax, directly easing the burden on middle-class families.

What Gets Expensive

-

Fast Food & Beverages: Products with added sugar, soft drinks, carbonated beverages, and processed snacks will now attract higher taxes.

-

Luxury & Entertainment: Casinos, online gaming, premium entertainment services, and tobacco-related products will face up to 40% GST, making them significantly costlier.

What It Means for Consumers

-

Buying luxury goods, cigarettes, or fast food before September 22 could mean some savings.

-

After the new slabs take effect, consumers will benefit most from cheaper electronics, household appliances, and farming-related goods.

-

The move is expected to boost consumer demand in electronics and agriculture, while discouraging spending on harmful or non-essential products.

With this reform, the government aims to simplify the tax structure, ease the financial burden on farmers and the middle class, and promote healthier consumption habits.

also read – Trump Signs Executive Order Granting Tariff Exemptions to Key Trade Partners on Industrial Exports